Discounted Cash Flow Valuation Excel

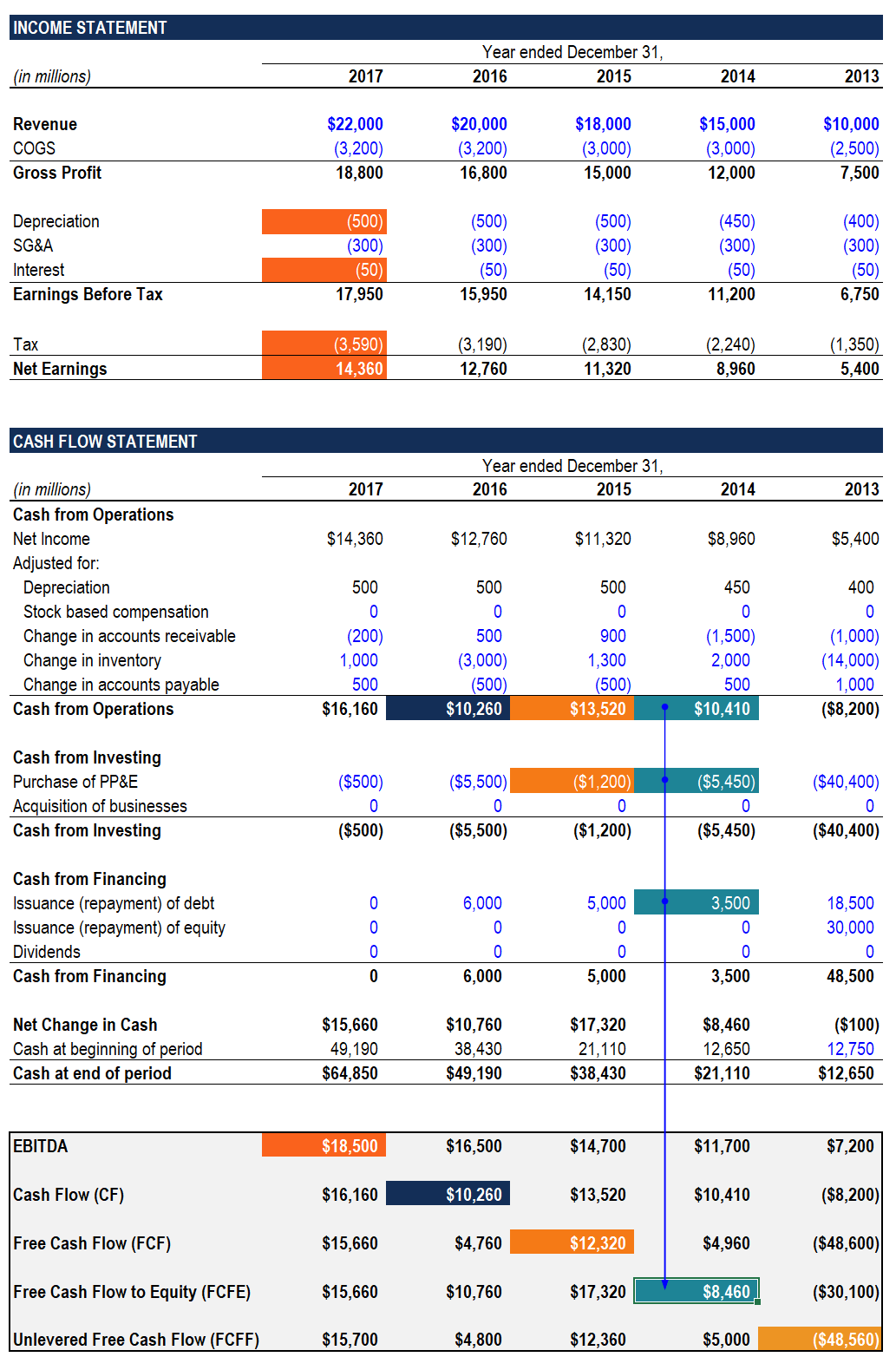

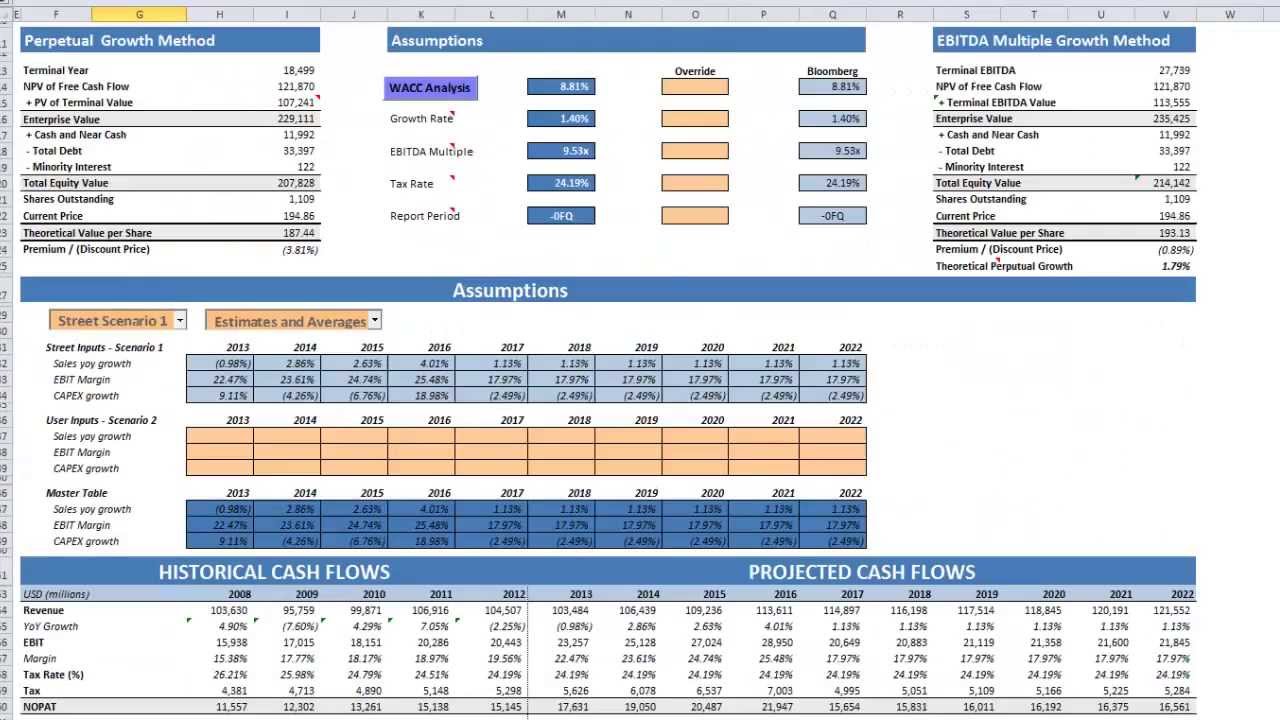

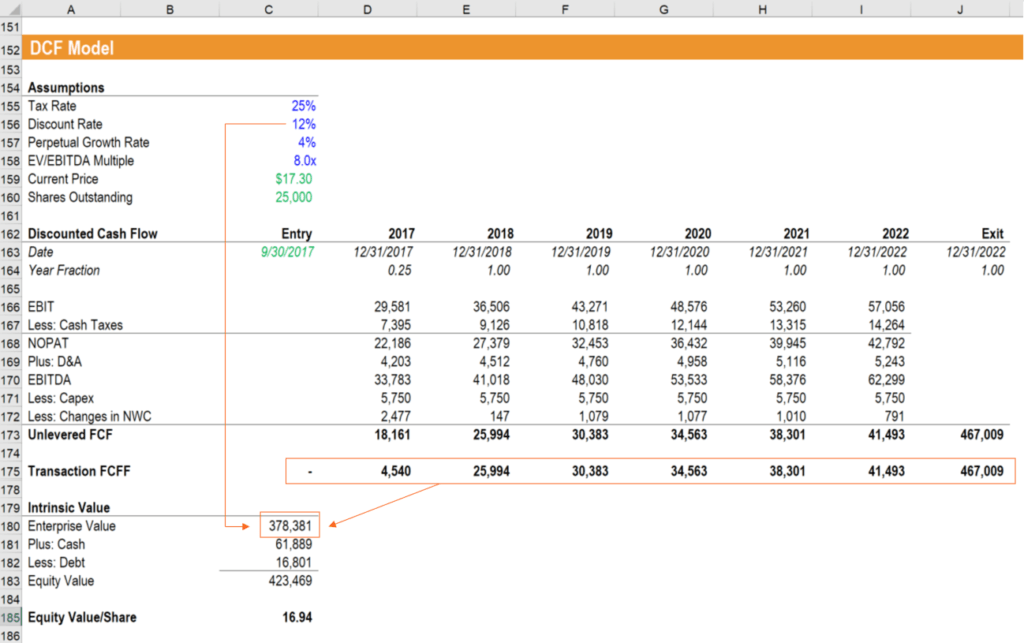

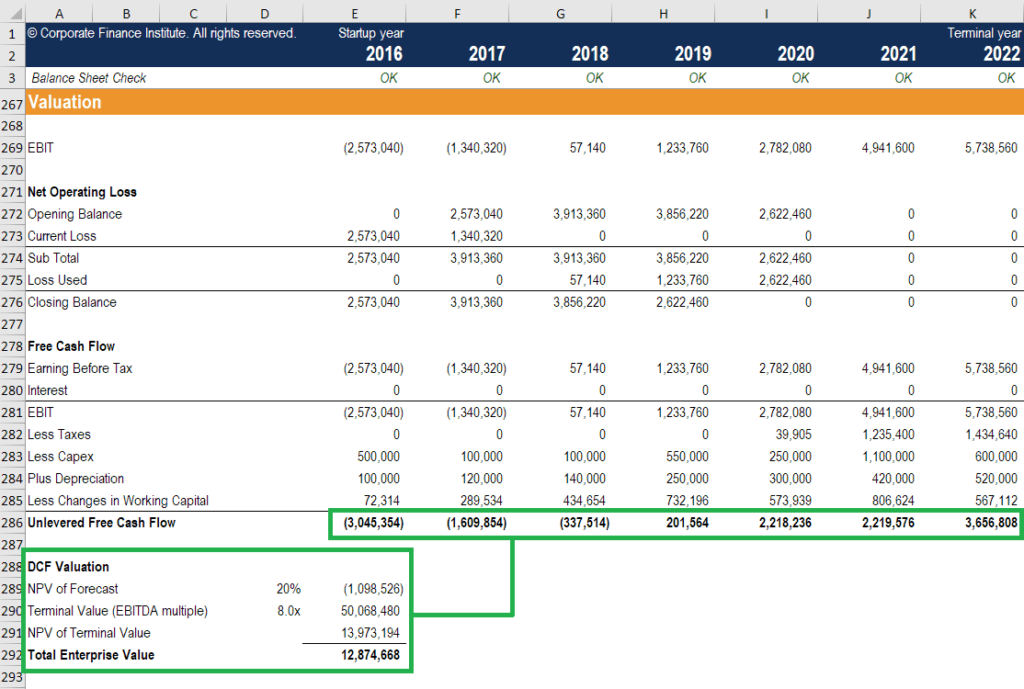

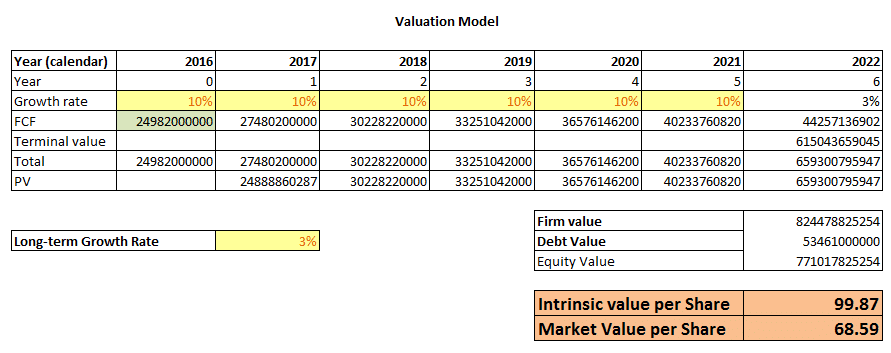

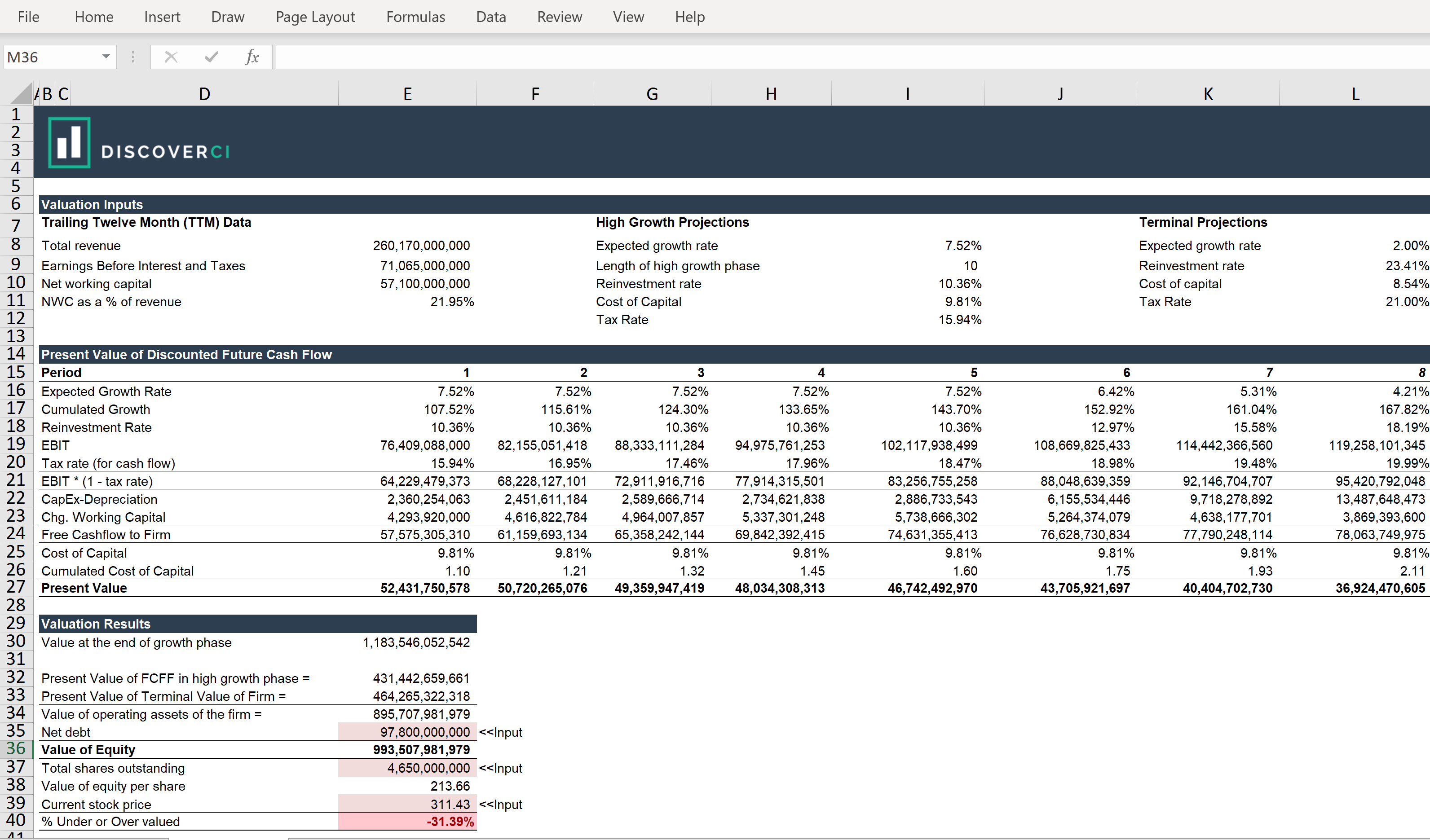

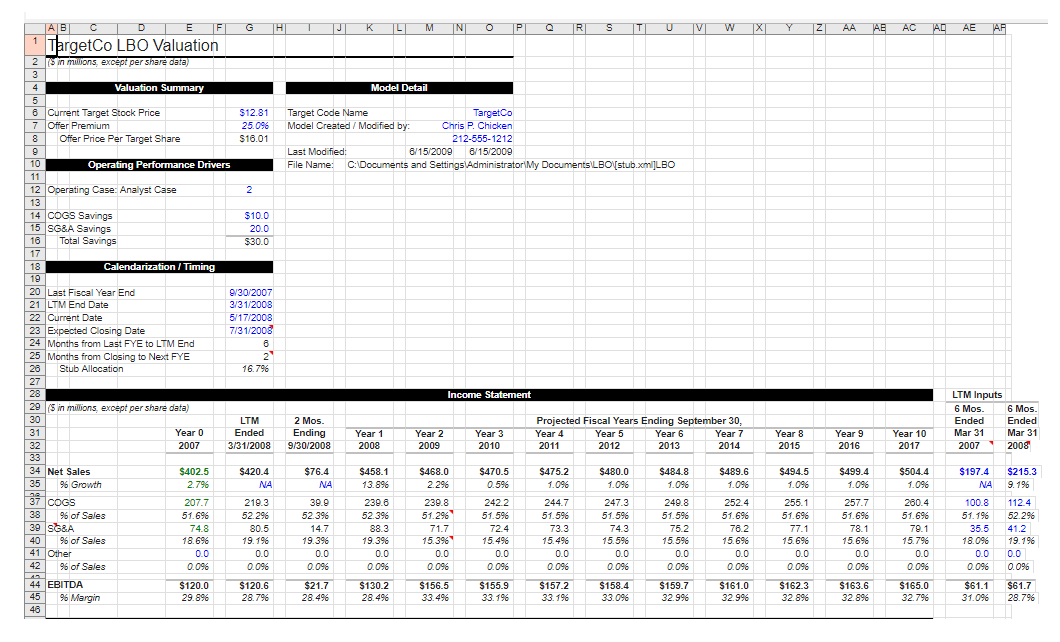

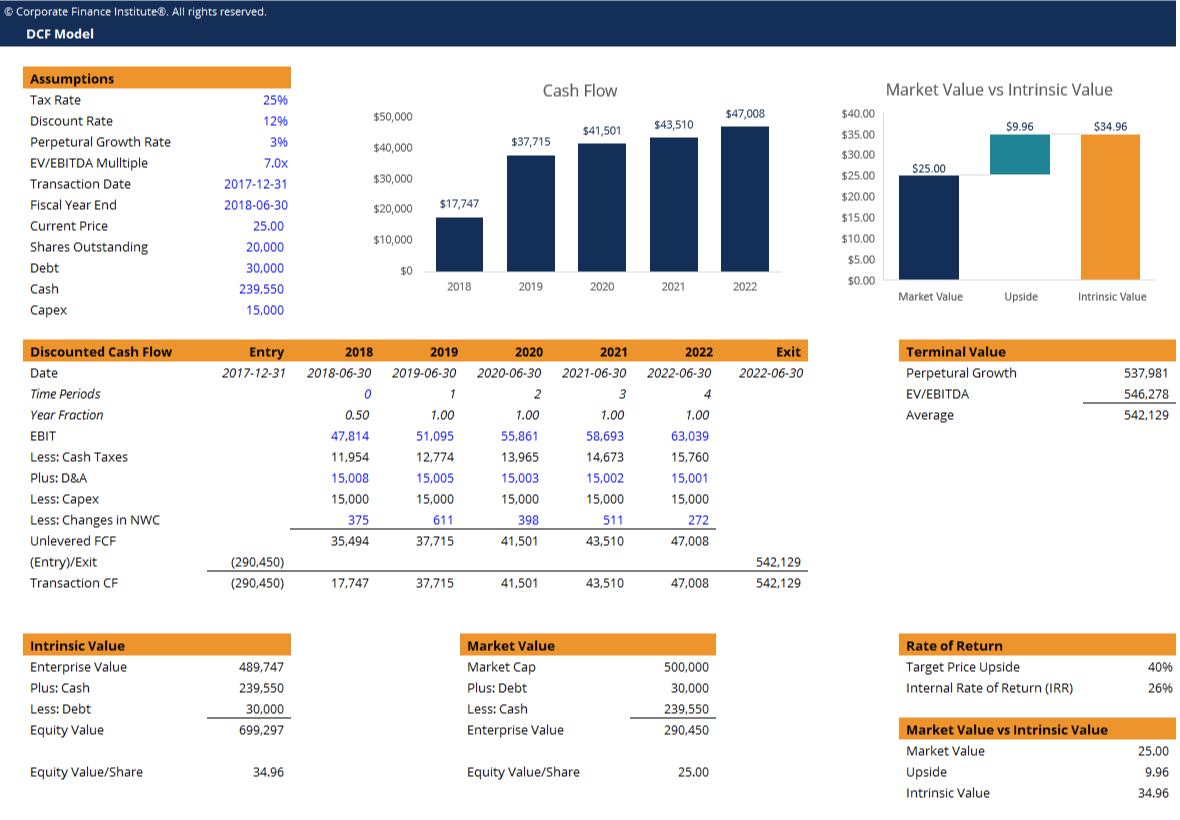

A discounted cash flow model dcf model is a type of financial model that values a company by forecasting its cash flows and discounting the cash flows to arrive at a current present value.

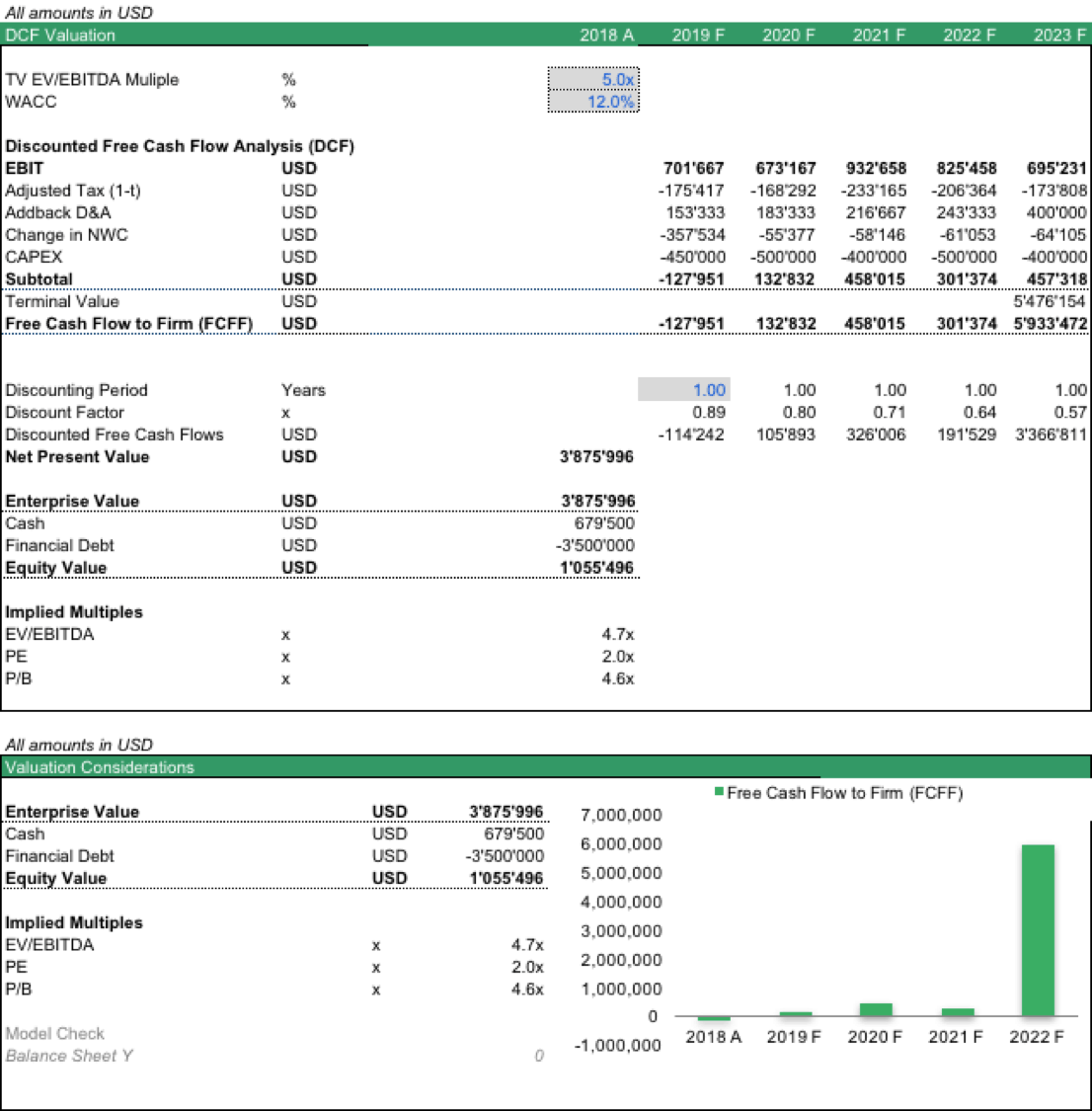

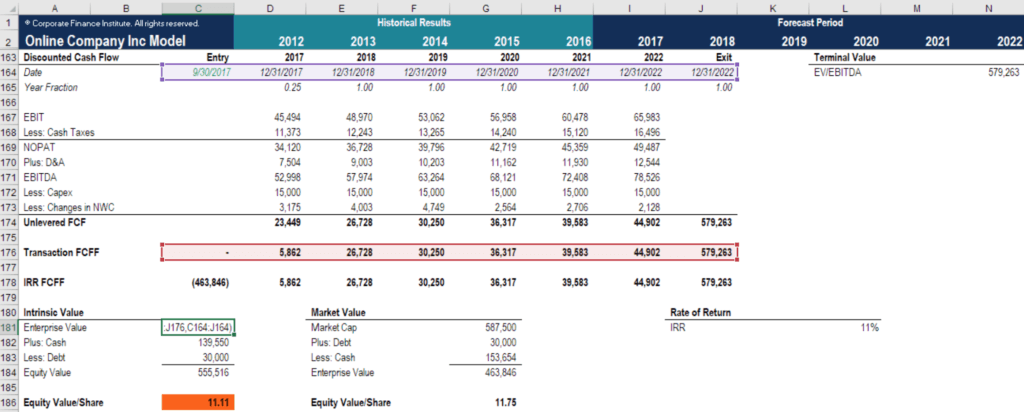

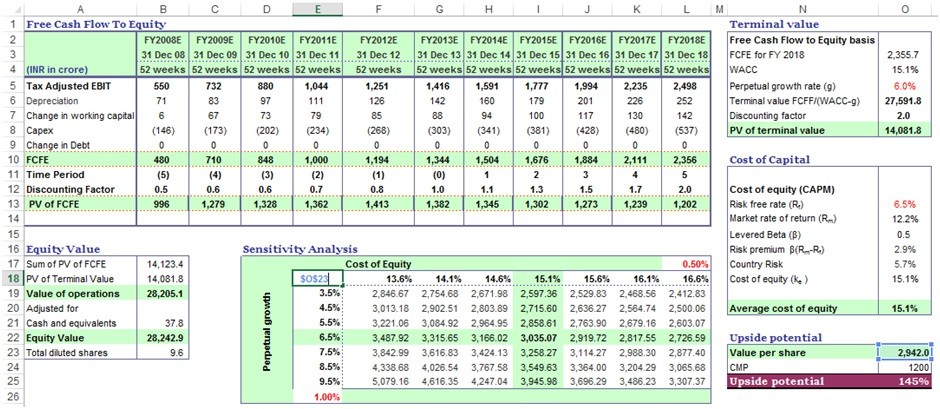

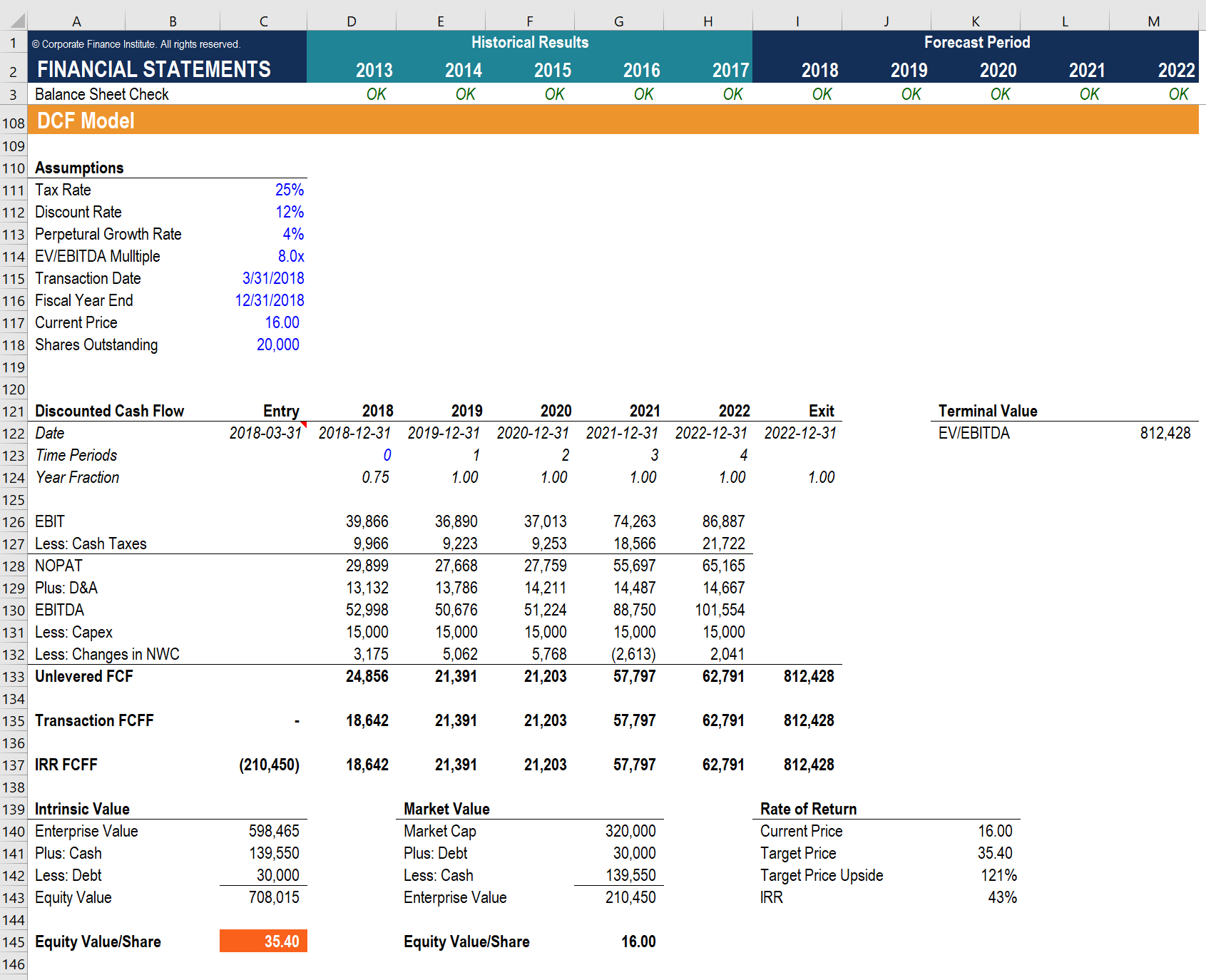

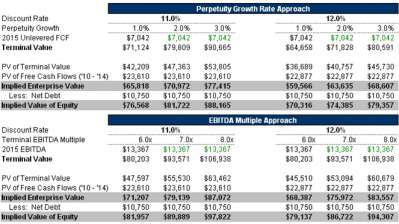

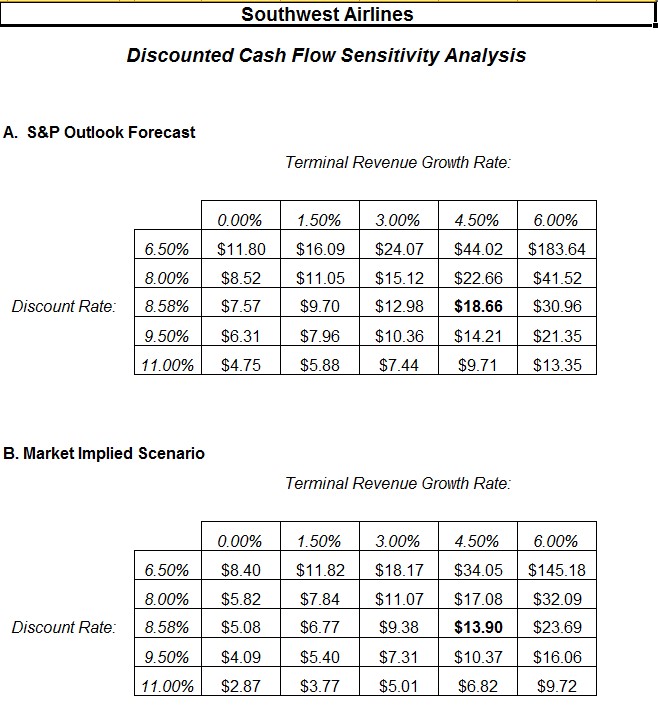

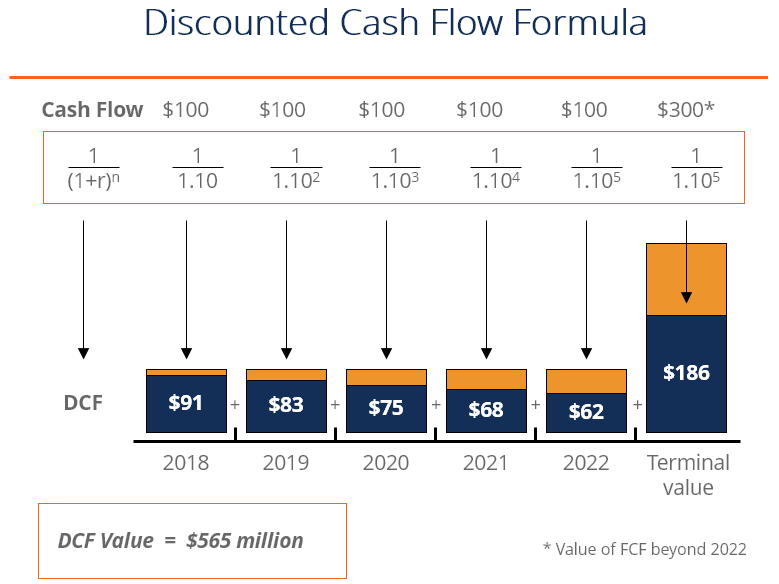

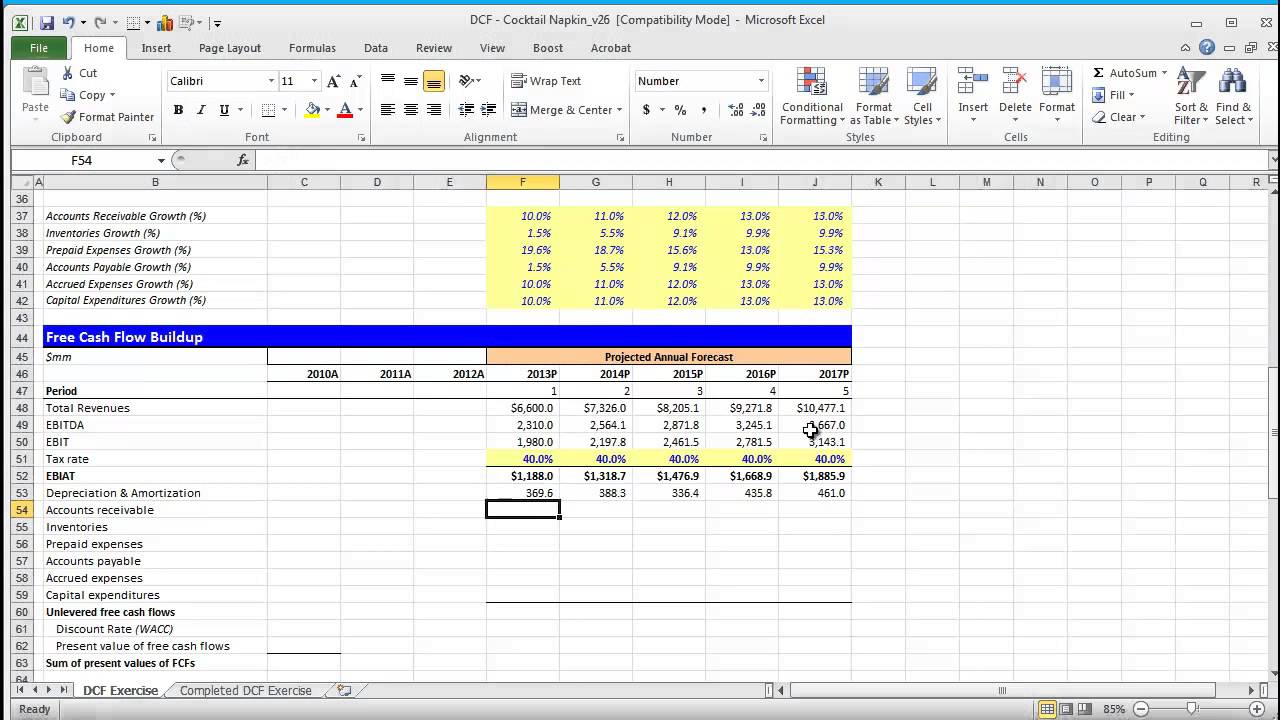

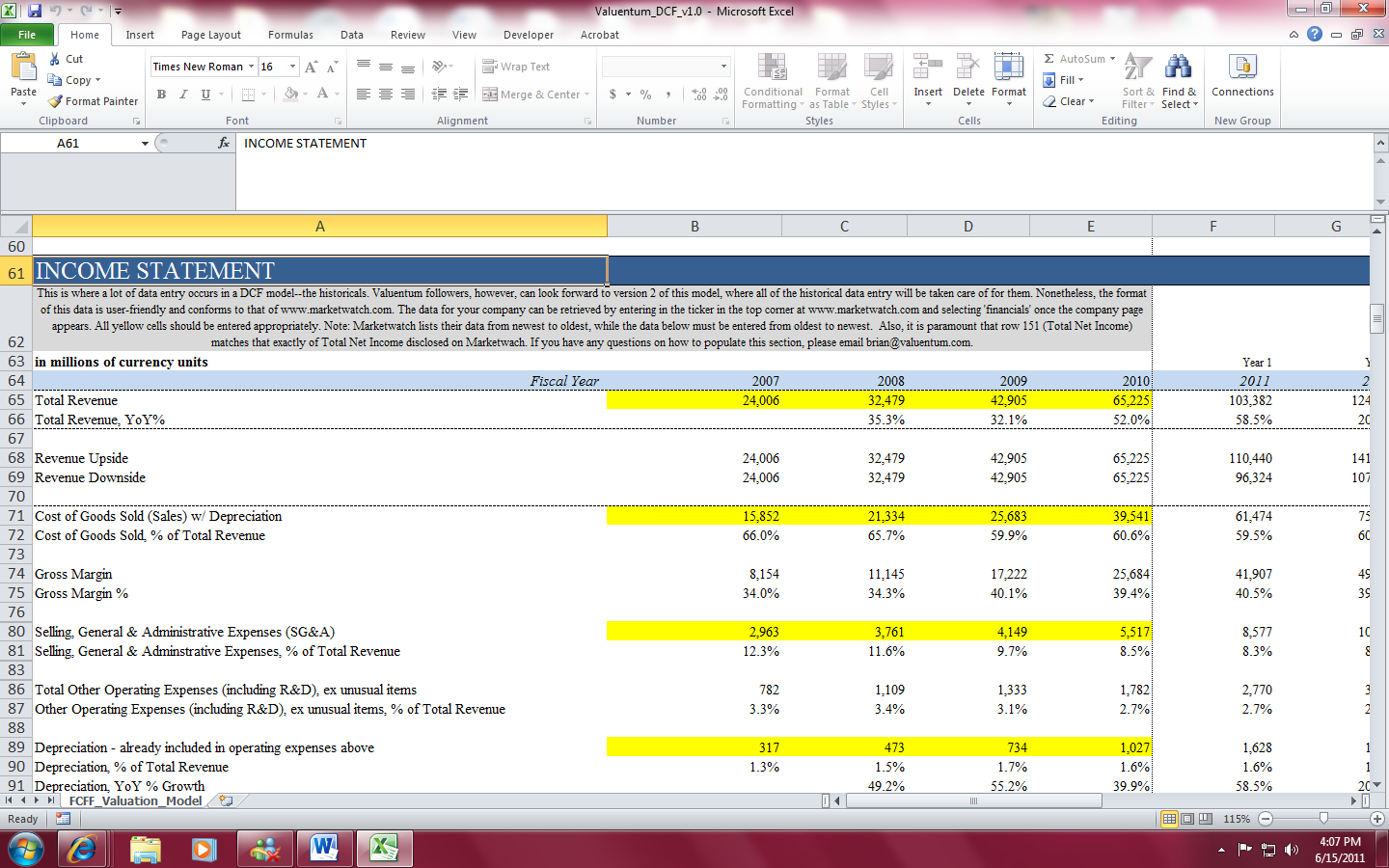

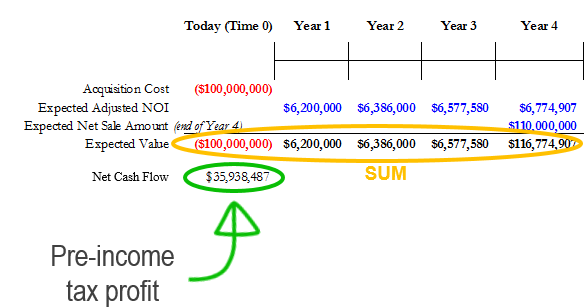

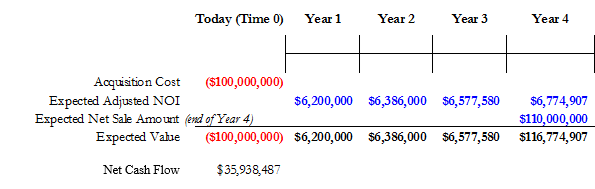

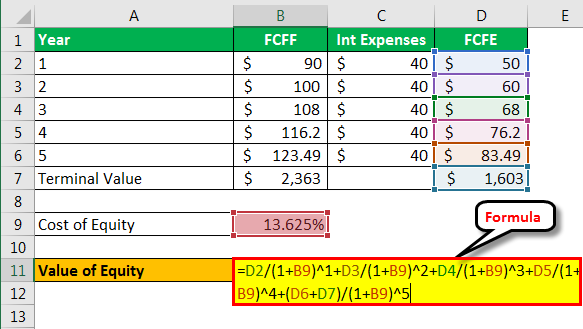

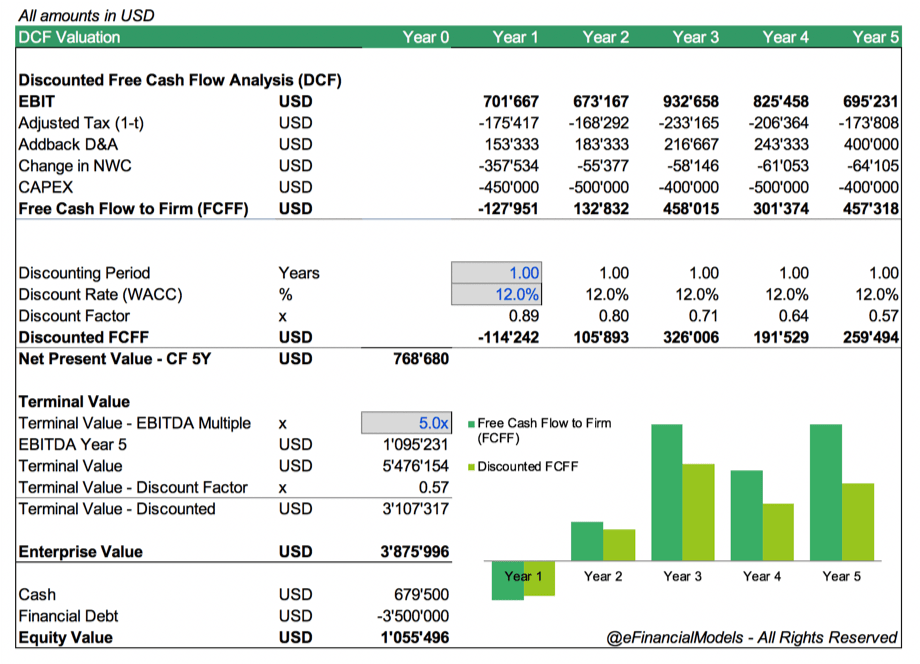

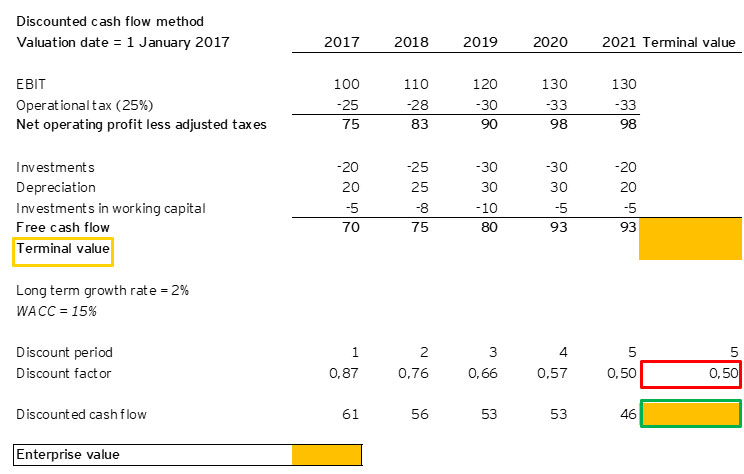

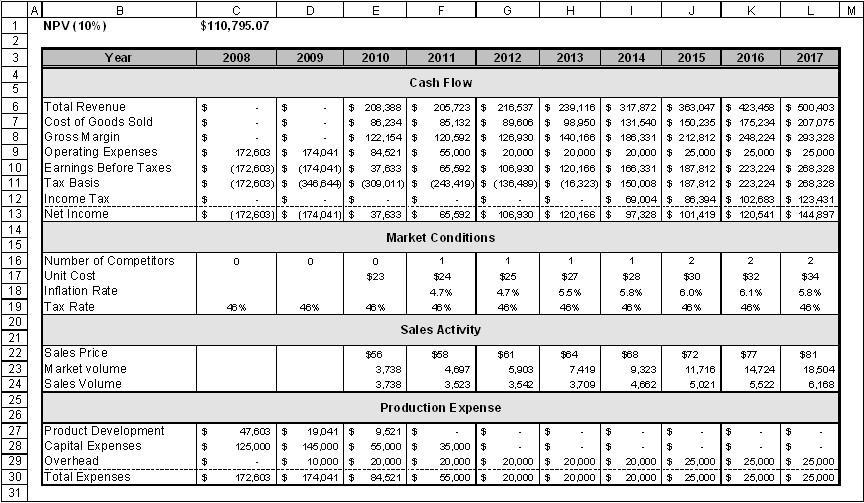

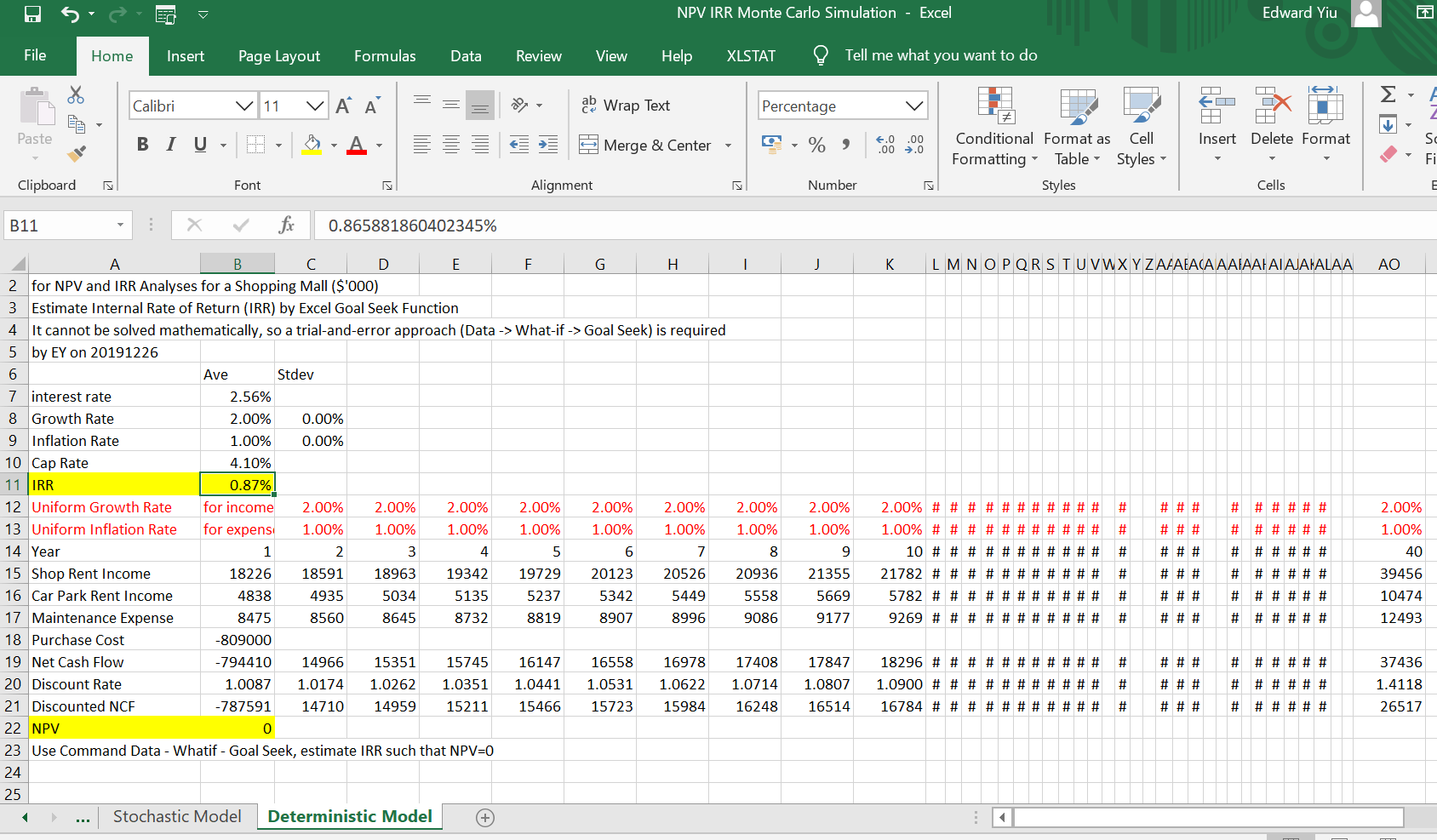

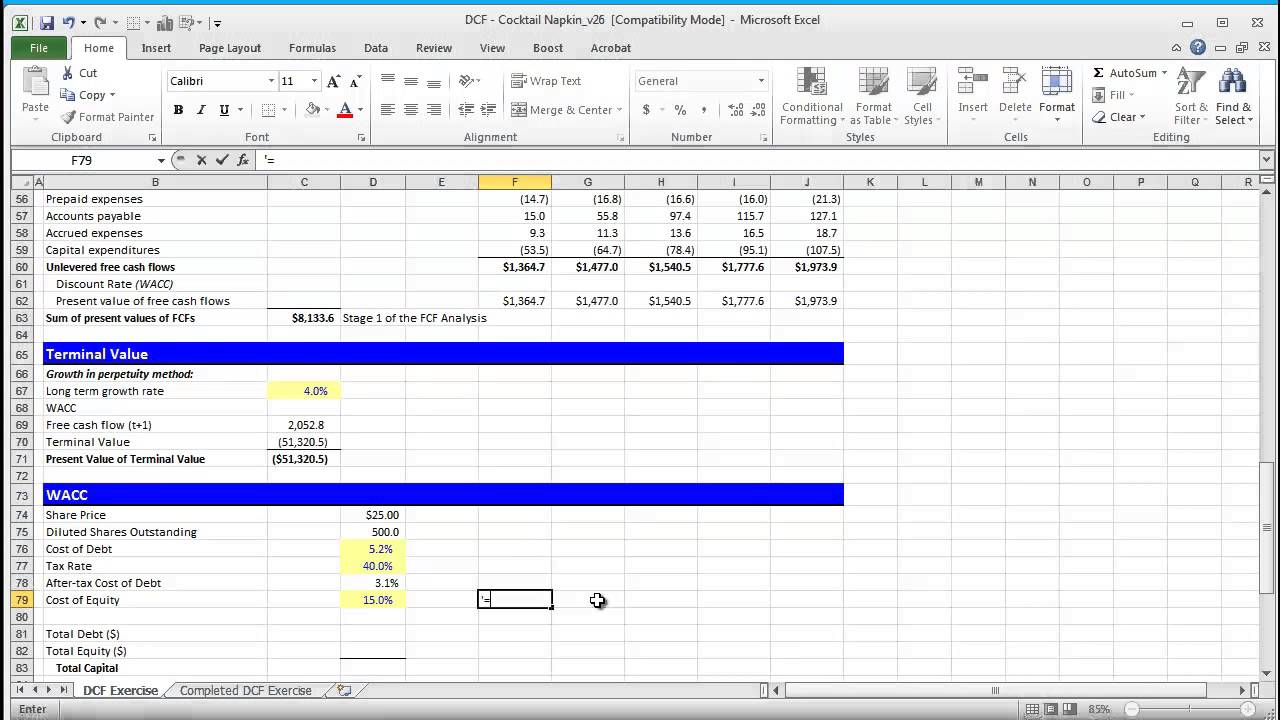

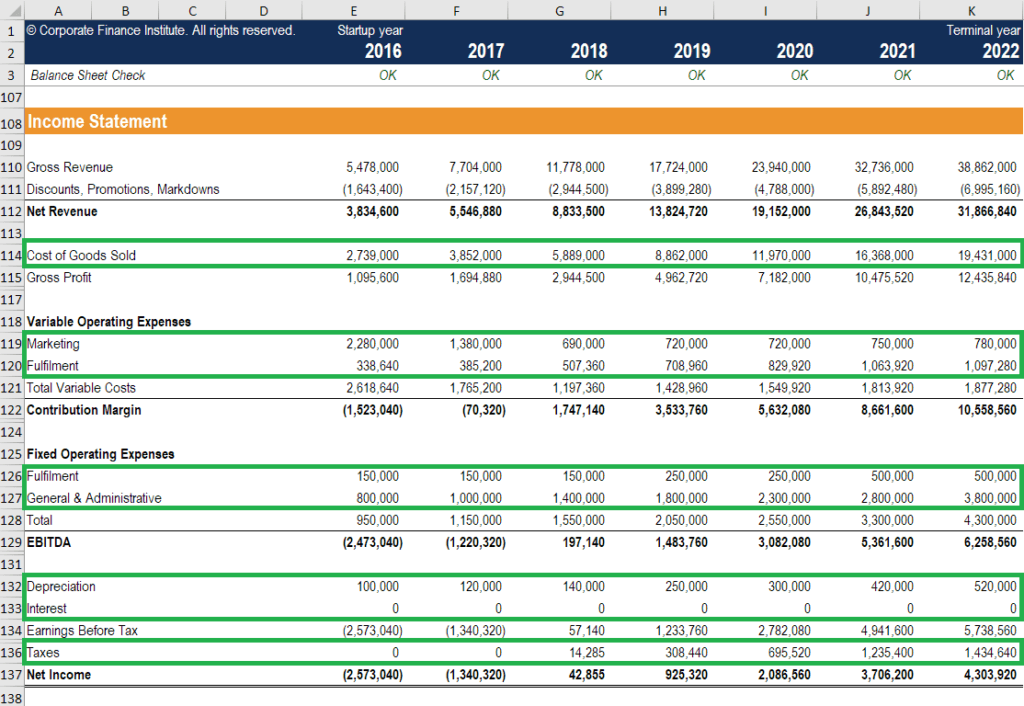

Discounted cash flow valuation excel. A dcf valuation uses a modelers projections of future cash flow for a business project or asset and discounts this cash flow by the discount rate to find what its worth today. Npvdiscount rate series of cash flows. Discounted cash flow valuation excel contents of the template. The next step would involve estimating the wacc weighted average cost of.

Enter the date of the valuation. Ms excel has two formulas that can be used to calculate discounted cash flow which it terms as npv. This would involve forecasting the expected cash flow based on the businesss. Net the sum of all positive and negative cash flows.

Forecast the expected cash flow. This amount is called the present value pv. Excel has a built in function that automatically calculates pv. Advantages of discounted cash flow valuation.

The detailed outline of the discounted cash flow process. The valuation date determines the period. The dcf valuation model builds on the 3 statement model by adding a business valuation component for investment through the discounted cash flows method. Present value discounted back to the time of the investment dcf formula in excel.

Discounted cash flow dcf excel template the dcf discounted cash flow model is a quantitative method of valuing a business based on the theory that the business is worth the sum of all of its future cash flows discounted back to their present value. Dcf step 3 discount the cash flows to get the present value in step 3 of this dcf walk through its time to discount the forecast period from step 1 and the terminal value from step 2 back to the present value using a discount rate. Included in the template you will find. The dcf has the distinction of being both widely used in academia and in practice.

Limitations of the. The discount rate is almost always equal to the companys weighted average cost of capital wacc.